When it comes to LEGO collecting, it is safe to say that a lot of us collect these toys because we enjoy the thrill that you get from building something out of bricks, or we have an appreciation for the minifigures and custom pieces which LEGO create. What many of us perhaps overlook, however, is the fact that LEGO can be a real opportunity to make investments which can bring us a return on investment in the future. Much like any other collectible, LEGO has a set shelf-life, and once that product leaves the shelves in our local toy stores, it can begin to accrue value if a few interesting parameters are met by the product.

In this article, we are going to look at some examples of LEGO sets which have gone from their normal RRP to a higher aftermarket value, and we are going to speculate why this may be the case. Do let me know if you find this article useful, as we may be able to look at more examples in the future if there is enough interest. For now, let’s take a look at the examples I wanted to explore in today’s article. The sets featured in this article come from catawiki, so make sure to check out their guide to the ‘Top 10 Most Expensive LEGO Sets’.

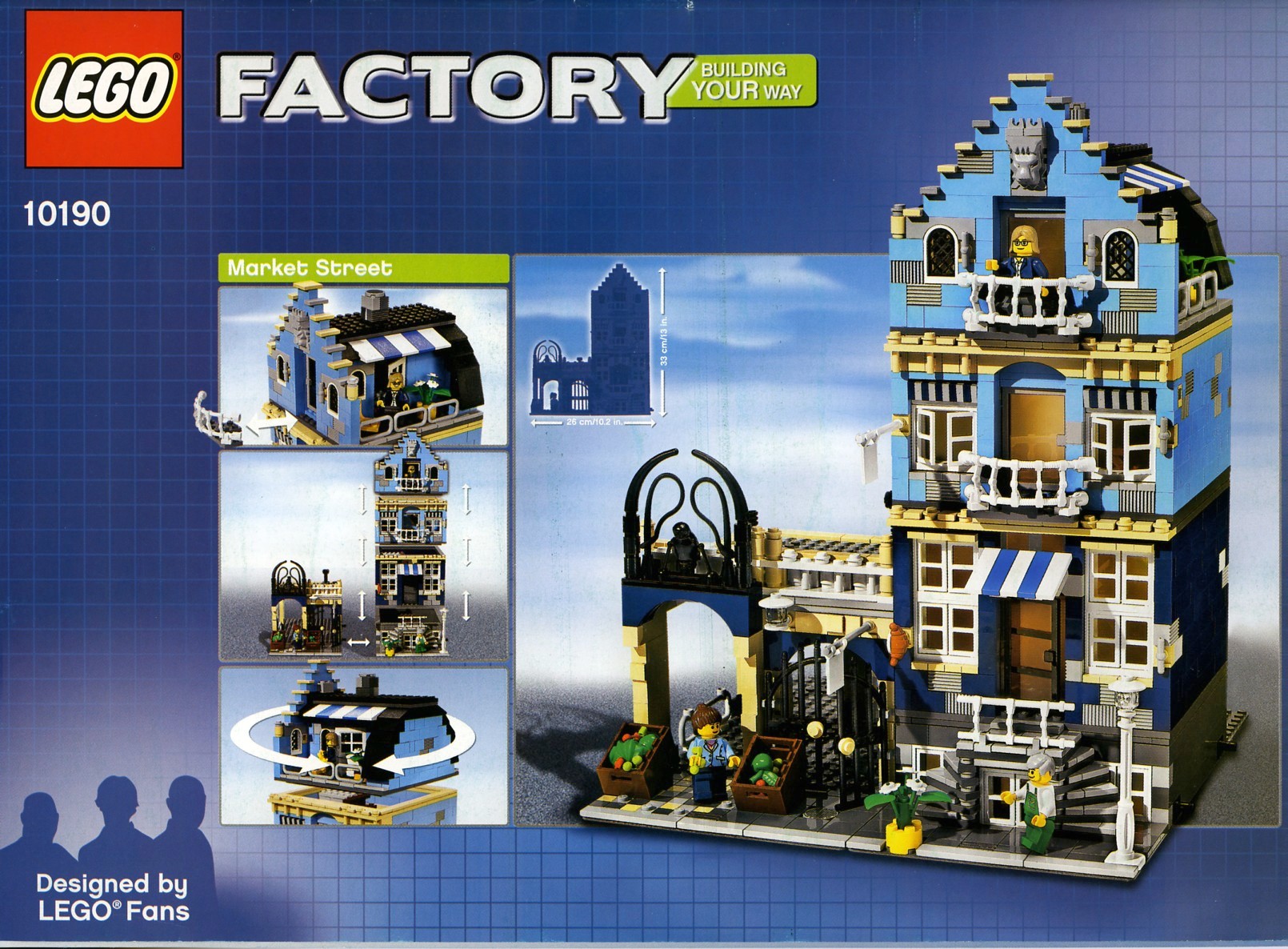

The first set which is mentioned in the above article is the LEGO Market Street (10190-1), a set which came out in 2007 for the retail price of just £59.99. Brickset now lists the new aftermarket price for it as £1505 – an incredible increase in value for a set which has just 1,248 pieces. So, what could have caused this increase in value? I believe there are several key elements here which have contributed to the growth in value of this product. First, is the release window for this particular product. This released before the Modular Series of LEGO sets were a common place on shelves in LEGO Shops, and therefore, this meant that the product was able to accrue a unique status as being one of the only larger LEGO buildings – something which was highly demanded at the time.

LEGO’s marketing nearly always shows full and extensive LEGO City models, so this automatically generated a large demand for a product like this, meaning it saw an incredible level of demand upon its release. Combine this with the fact that it was a LEGO exclusive, designed by LEGO fans, and you can begin to see why this item accrued so much value – because it released in a time window where there was a lot of demand for the product, and released with a unique set of factors which meant that it grew in both demand and value very quickly. This helps to create a rough idea for what exactly you should look for when it comes to planning to invest in LEGO products – something which we will come back to at the end of this piece after we look at a few more examples.

Get the Latest LEGO Sales & Deals

Another interesting set to consider is LEGO’s rendition of the iconic 10189-1 Taj Mahal – the largest LEGO set which was ever produced at its time, in 2008. This set released with 5922 pieces and retailed for just £199.99 – showing just how much of a good purchase this was at the time as the part per piece value alone at the time was incredible. In truth, it is hard to imagine how LEGO actually made much money off of this set – as despite its limited release, it really did seem to undercut the market value for LEGO sets. In truth, this exceptionally good value for money, combined with the limited edition release and the fact that it recreated a real-world icon meant that for many years, this set accrued a level of demand like no other – easily selling for over £1000 new-in-box.

However, LEGO saw this demand, and did eventually re-release the set as 10256-1 – something which shattered the aftermarket value of the product as it fell to just £500 new-in-box, which is what the current Brickset listing for this set suggests. This highlights how quick changes in the LEGO investment market can have massive implications for just how much return-on-investment you can make on your purchases, something which we will discuss in more detail at the end of this piece when we discuss our recommendation for making your own LEGO investments.

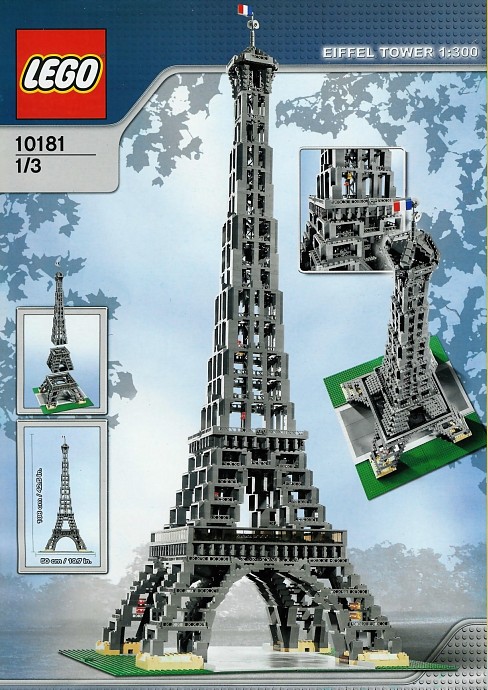

Another good example of a real-world model which has accrued value of the years is set 10181 – Eiffel Tower. This is a Creator Expert set which recreates the iconic tower seen in Paris, France. The set retailed for £146.79 at its release point in 2007 and included 3428 pieces. The set is not minifigure scaled, but it incorporated lots of architectural details to embrace the display-piece sign which LEGO were really attempting to play with at the time. Interestingly, this set was also a LEGO exclusive like the Taj Mahal set, but this set never received a repackaged re-release, and therefore this set’s value has never fluctuated, with it selling for over £1000 new-in-box on the aftermarket.

Whilst it is possible to argue that all of these sets which accrue value seem to be from bygone eras and bygone licenses, there are examples of more modern sets which have released, been available fairly-widely on the market, and have then increased in value afterwards. The key principle, when it comes to thinking about LEGO investment, is to not look at investing in a single item, but to rather, build a portfolio of different items which will come together to generate a significant return on investment over time. This is something which we will discuss a little bit more at the end of this article, but before we get to that point, I’d like to briefly touch on one of the more modern examples of an increased value post-release, as this will help to round out what I believe you should be looking for as a LEGO investor.

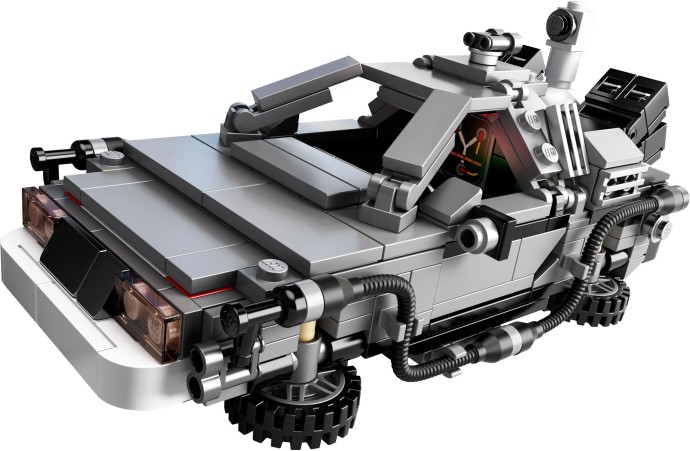

The last set I wanted to highlight today is 21103-1 The DeLorean Time Machine. This set released in 2013 as a part of the LEGO IDEAS license, and creates the iconic vehicle from Back To The Future whilst also incorporating minifigures of the two main characters. It retail for £34.99 when the set first released, but nowadays the set, new-in-box, can go for nearly triple its retail price, meaning that whilst this investment is not going to make you a large sum of money like the Eiffel Tower set we looked at prior, it can still contribute healthily to a return on investment if we were to buy several of this product and sell them on the aftermarket.

The key thing here, with the DeLorean, is timing and demand. BTTF has always been an evergreen household franchise and a key part of pop culture, and so this means there has always been a continuous level of demand for this product. If we take this into account, it becomes clear that more people will want to purchase this item over time – meaning that the longer we come from the release date with the same amount of demand, then naturally, the return on investment we can make will increase. This is something important to consider. I’m now going to explain a little bit more about how all of these sets are connected – hopefully allowing you to think a little bit more about where good investment opportunities may lie.

So, what do all these sets have in common? The answer is – a few things. Firstly, they tend to be items which are not widely available, but rather, are likely to only be available as LEGO shop or retailer exclusives. This already means that the items are not widely distributed; something which helps to limit aftermarket availability and therefore increase value. Secondly, they tend to either mimic real-world locations, or, will be from licenses which have evergreen appeal, as this means there will always be a market for them. LEGO Ideas is the best example for this, as whilst the DeLorean has accrued significant value, the TARDIS set hasn’t, showing that only sets with broader appeal will increase value.

Thirdly, and arguably most importantly, the sets do something unique. Whether a unique vehicle or a unique location, the sets which tend to increase in value the most are the ones which try something which LEGO may never do again – meaning that fans of the products will want to pick them up as they may never see a product with the same stylisation again. If you consider these key things, you want to look for something unique and limited in number which has a key appeal – whether that be a brand or location – which is likely to resonate with audiences long after its release. If you follow these principles, then you are likely to make some successful investments in your LEGO collection.

Did you enjoy this article? Would you like to see more on LEGO investing in the future? Let us know, as if you did, we can write more in the future! And, until the next time, make sure to check out some of my other work here.

Get the Latest LEGO Sales & Deals